35+ s corp and qualifying for mortgage

Compare Now Find The Lowest Rate. Ad Learn More About Mortgage Preapproval.

Infinity Financial Group Aids Kinley Construction Group With Major Stakeholder Buyout Send2press Newswire

However the income you can.

. Ad Compare the Best Home Loan Lenders for February 2023. In other words an S-corp is a tax status. Special Offers Just a Click Away.

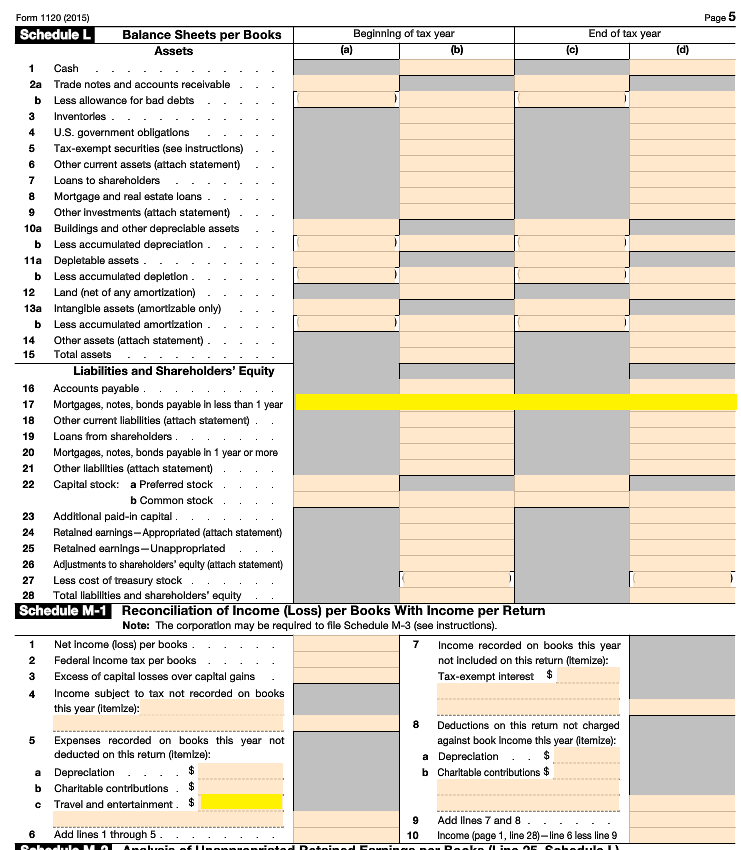

Web Schedule C this is for sole proprietors that are self-employed. Schedule D this is for capital gains and. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

75000 Average yearly income. Web You can then submit your personal W2 and paycheck stubs for the loan application and if there is left over income that flows through the S corp then you will issue yourself a K1. With a Low Down Payment Option You Could Buy Your Own Home.

The Self-Employed Income Analysis Form 1084A or. FHA loan limits have also increased in 2021 rising to 356362 in most areas and. Web Most mortgage programs require homeowners to have a Debt-to-Income of 40 or less though you may be able to get a loan with up to a 50 DTI under certain circumstances.

Compare Mortgage Lenders And Find Out Which One Suits You Best. To qualify for S corporation status the corporation must. Ad Compare the Best Home Loan Lenders for February 2023.

Contact a Loan Specialist to Get a Personalized USDA Loan Quote. Web To qualify for S corporation status a business has to meet certain Internal Revenue Service IRS requirements. Get Instantly Matched With Your Ideal Mortgage Lender.

Web Heres how a lender would calculate your monthly income for qualifying purposes. Savings include 0 Down No PMI and More. Web For an FHA loan applicants with a score as low as 500 may be considered.

Easily Customize Your Loan Agreement. The business income must be stable and. It has to be incorporated domestically within the.

Ad Compare the Top Mortgage Lenders Find What Suits You the Best. Why Rent When You Could Own. Use NerdWallet Reviews To Research Lenders.

Web The ceiling for one-unit properties in most high-cost areas is 822375. Download Print Anytime. Ad See what your estimated monthly payment would be with the VA Loan.

Web Business income may only be used to qualify the borrower if the lender obtains documentation verifying that the income was actually distributed to the borrower. With a Low Down Payment Option You Could Buy Your Own Home. Compare Mortgage Lenders And Find Out Which One Suits You Best.

Web An S-corp is a type of corporation that elects to pass corporate income loss deductions and credits to its shareholders. Web The Best S Corp And Qualifying For Mortgage ReferencesUltimately it depends on the loan product youre using to qualify with but for the purposes of. Web the stable on-going income that is needed to approve the mortgage.

Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualification In Minutes. Choose Smart Apply Easily. Check out our Schedule C calculator to determine the qualifying income.

Ad Check Your USDA Mortgage Eligibility Today. Ad Get ALoan Agreement Using Our Simple Step-By-Step Process. EVALUATING S CORPORATION TAX RETURNS.

Web Ordinary income from the corporation can be used to qualify the borrower only if the following requirements are met. Ad Tired of Renting. Browse Information at NerdWallet.

But 580 is the minimum credit score to qualify for the 35 down payment advantage. Web S corporations are responsible for tax on certain built-in gains and passive income at the entity level. Web To qualify for a mortgage you will need to provide a wide variety of information including documents related to your income.

Take Advantage And Lock In A Great Rate.

The Mckinsey Valuation Measuring And Managing The Value Of

V I P Mortgage Inc Linkedin

Bond Market A Tad Antsy About Inflation Not Just Vanishing One Year Yield Nears 5 Mortgage Rates Back At 6 5 Wolf Street

Slide 007 Jpg

What Credit Score Is Needed To Buy A House

Mortgage Providers Are Tightening Their Lending Requirements And Fewer Canadians Are Qualifying A Popular Alternative To Banks During The Housing Boom Private Lenders Are Now Tightening Their Lending Requirements In

S Corp Vs C Corp Understanding The Differences Lendingtree

Self Employment Income Mortgagemark Com

New Fed Mortgage Corp Nmls 1881 Newfedmtg Twitter

The Broker Channel Gets Another Prime Lender Strive Capital Mortgage Rates Mortgage Broker News In Canada

35 Sample Proof Of Funds Letters In Ms Word Pdf Ms Word Google Docs

Cmhc Funding Model Questioned After Halt Of Non Profit Vancouver Housing Project R Canada

Self Employed Mortgage Loan Requirements In 2023

Homepage Vogue Dkbs

Independent Investment Advice Personalized Service Warren Buffett Style Value Investing

Ex 99 2

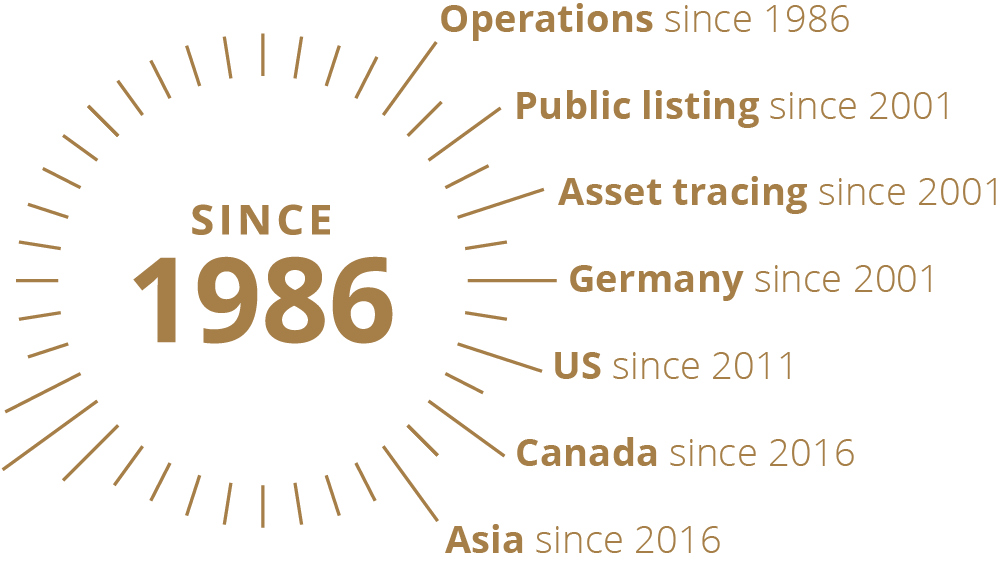

Omni Bridgeway Litigation Financing Litigation Funding